Join Us in Offering Free Financial Literacy Education to Kids Everywhere.

Your generous donations make it possible for us to offer our interactive, online financial literacy course free of charge to kids aged 8-14, ensuring financial literacy is accessible to all.

Our Mission

Bossdoconline is on a mission to empower the next generation with the skills they need to succeed in life by providing free, interactive financial literacy education to kids between the ages of 8-14. Financial literacy is an essential life skill that sets children up for a lifetime of financial success. Unfortunately, not all children have access to financial education, and that’s where Bossdoconline comes in. Your donations us to offer our interactive online financial course to children all over the country, completely free of charge.

An Engaging and Fun Course

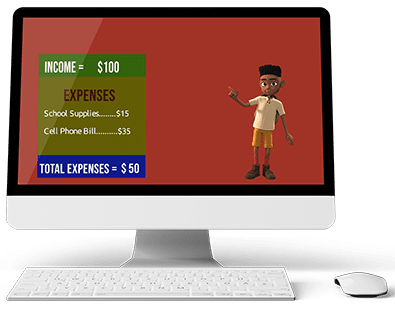

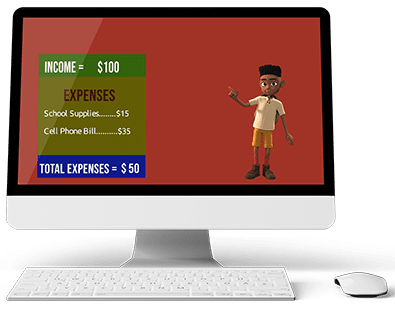

Our online, interactive video course, “Smart with Money by the Boss Doc”, is designed to be fun and engaging for kids, with colorful animations and relatable characters. Kids who complete the course will receive a certificate of completion, which they can proudly display as proof of their newfound financial knowledge.

Where does your Money Go?

We were selling the course for $9.99 and it’s worth that and more.

But it is more important to us that we get this essential course into as many households as we can. Especially to those that may not be able to afford it. But as important as Smart with Money is, we can’t reach people if they don’t hear about it. This requires an extensive marketing budget across radio, TV internet, and print.

Your generous donations will allow us to increase awareness about our Financial literacy course and offer it for FREE!

We Must do This

Teaching kids about money at a young age is incredibly important because it sets them up for a lifetime of financial success. The skills and knowledge they learn now will impact their financial decisions for years to come By providing children with the tools and knowledge they need to make smart financial decisions, we can help them achieve financial success and security in the future.

These Stats are Concerning

- According to a study by the Organization for Economic Co-operation and Development (OECD), one in four 15-year-olds in developed countries lack basic financial literacy skills.

A 2019 survey by the National Financial Educators Council found that only 24% of American kids feel confident in their ability to manage their own money.

The same survey found that 60% of American parents feel that their children are not learning enough about personal finance in school.

In a survey conducted by the National Endowment for Financial Education, nearly three-quarters of American parents reported at least some reluctance to talk to their kids about financial matters.

A 2020 survey by the Jump$tart Coalition found that only 21% of American high school seniors are proficient in personal finance topics, such as budgeting, saving, and investing.

These statistics highlight the importance of teaching kids about financial literacy at a young age. By providing children with the tools and knowledge they need to make smart financial decisions, we can help them achieve financial success and security in the future.

FAQs

I’m not familiar with your organization.”

We understand your concern. We encourage you to visit our website and social media pages to learn more about our organization, our mission, and the impact we’ve already made in the lives of children. We are transparent about our goals and achievements, and we’re always available to answer any questions you may have.

“How do I know my donation will be used effectively?”

We value your trust and take accountability seriously. We have a strict financial management process in place to ensure that donations are used efficiently and effectively. We provide regular updates and reports on how funds are allocated and the progress we’ve made in reaching our goals.

“I don’t have much money to donate.”

Every donation, no matter the amount, makes a significant difference. We appreciate any contribution, and even a small donation can help us in our mission. Additionally, we offer various ways to get involved besides monetary donations, such as volunteering your time or sharing our cause with your network.

“Why should I donate to financial literacy when there are other pressing issues?”

Financial literacy is a crucial life skill that empowers individuals to make informed decisions and build a stable future. By supporting our cause, you’re helping create a ripple effect that positively impacts not only the children themselves but also their families and communities. Financial literacy is an investment in breaking the cycle of poverty and fostering long-term self-sufficiency.

“I’m not sure if financial literacy is really that important for children.”

Financial literacy equips children with the knowledge and skills they need to navigate their financial lives successfully. It empowers them to make wise financial decisions, avoid debt, and build a strong foundation for their future. Teaching financial literacy at a young age sets them up for lifelong success and independence.

“I prefer to donate to causes that directly address immediate needs.”

We understand the importance of addressing immediate needs, and we appreciate your concern. By supporting our cause, you’re helping create long-term solutions to financial challenges that many children face. Financial literacy education provides the tools necessary to break the cycle of poverty and make lasting changes in their lives.

“Can I trust that my personal information will be secure?”

Answer: We prioritize the security and privacy of our donors. We have strict data protection policies in place and use secure encryption technology to safeguard all personal information. Rest assured that your information is handled with the utmost care and will not be shared with any third parties without your explicit consent.

“How do I know the course will be engaging and effective for children?”

Our financial literacy course has been designed with the input of educational experts to ensure maximum engagement and effectiveness. We use interactive videos, animations, and relatable characters to make the learning experience enjoyable for children. We continuously assess and improve our course based on feedback and results from participants.

“What if I want to contribute in a different way, besides monetary donations?”

We appreciate any form of support. Besides monetary donations, you can contribute by volunteering your time, spreading awareness about our cause on social media, or even organizing fundraising events. Every effort counts and helps us reach more children with our financial literacy program. Feel free to reach out to

Registration

Exciting News! “Smart with Money” Course is Now Free for Kids Ages 8-14, Thanks to Your Generous Donations!

We have incredible news to share! Thanks to your generous donations, the “Smart with Money” course is now available for free to all kids aged 8-14. We are thrilled to offer this valuable learning opportunity without any barriers.

If you’d like to register your kids for the course, simply click here. It’s a seamless process, and they can begin their journey to financial literacy right away.

Your support has made this possible, and we couldn’t be more grateful. Together, we are equipping the next generation with the essential skills to make smart money choices.

Thank you for being a part of our mission and helping us empower kids with financial knowledge!