Our fun, interactive online video course teaches kids 8-14 about money

- Our courses teach kids aged 8-14 how money really works

- Set your child up to be financially stable

- No matter where they are, where they come from, or where they are going!

Money is an essential part of our daily lives

Developing good money management skills at an early age can help kids become financially responsible adults.

This course will teach kids the following and much, much more..

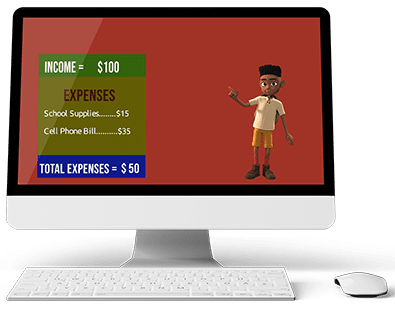

Basic money concepts: introduction to currency, saving, spending, and budgeting.

Importance of setting financial goals and strategies to achieve them.

Tips for avoiding common financial pitfalls, such as impulse buying and overspending.

Through interactive lessons and fun activities, kids will learn how to create a budget, set financial goals, and make smart financial decisions.

Our video course with tests is designed to provide a comprehensive learning experience for kids aged 8-14 who want to learn about money management. The course will consist of a series of engaging and informative videos, along with quizzes and assessments to help students track their progress and reinforce their learning.

Upon completing the course, kids will receive a downloadable certificate that acknowledges their achievement and demonstrates their understanding of the key concepts and skills covered in the course. This certificate can be shared with family and friends as a source of pride and accomplishment.

Money management skills are essential for their future: Money is an essential part of our lives, and developing good money management skills at an early age can help kids become financially responsible adults. Teaching kids about budgeting, saving, investing, and managing debt can help them make informed decisions about their finances and avoid financial mistakes later in life.

In today’s fast-paced world, this is MUST KNOW information for all kids everywhere!